Nairobi’s Real Estate:

Drivers and Future Insights

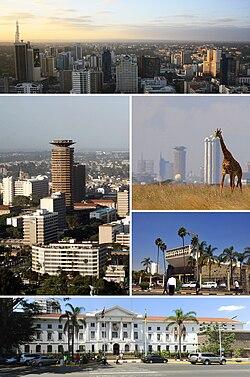

Nestled at the heart of East Africa, Nairobi stands as a vibrant testament to growth and transformation. As a city where the modern skyscrapers of bustling business districts juxtapose the rich tapestry of cultural heritage, Nairobi’s real estate landscape is a captivating mirror of its evolution. This dynamic market, driven by a myriad of factors—from rapid urbanization and a burgeoning tech scene to infrastructural development and demographic shifts—offers a wealth of opportunities for investors, homeowners, and urban planners alike.

However, with potential comes complexity; understanding the intricacies that fuel this sector is essential for navigating its promising waters. In this exploration, we will delve into the key drivers shaping Nairobi’s real estate market today, while casting a discerning eye toward its future prospects.

Exploring Economic Catalysts Behind Nairobi’s Real Estate Boom

Nairobi’s real estate boom can be attributed to several dynamic economic catalysts that intertwine to create a compelling investment landscape. With a rapidly growing population, the demand for residential and commercial properties has surged. This urban migration is fueled by people seeking better employment opportunities, education, and overall quality of life.

Furthermore, the government’s commitment to infrastructure development has accelerated the growth of key transport links, making previously less accessible areas more attractive for real estate investment. Emerging sectors such as technology and finance are also driving the demand for office space, as both local and international companies set up in Nairobi, positioning the city as a key player in Africa’s economic narrative. The rise of urbanization has led to increased interest in mixed-use developments that not only provide living spaces but also amenities and workplaces within a single location.

In addition, foreign investments in the real estate market have introduced new capital, bringing in innovative construction techniques and sustainable practices. these factors not only reveal the comprehensive growth strategy of Nairobi but also suggest a promising future for investors and residents alike.

Key Economic Factors Influencing Nairobi’s Real Estate Market:

- Urbanization: Continuous influx of people seeking better opportunities.

- Infrastructure Development: Improved transport links enhancing accessibility.

- Foreign Investment: Increased international funding leading to modern developments.

- Emerging Sectors: Growth in technology and finance creating demand for office space.

- Mixed-Use Developments: An appealing option for modern city living.

Investment Insight Table

| Sector | Your Investment Potential |

|---|---|

| Residential | High Demand |

| Commercial | Growing Interest |

| Agribusiness | Emerging Opportunities |

| Hospitality | Tourism Rebound |

Regulatory Frameworks for Sustainable Development

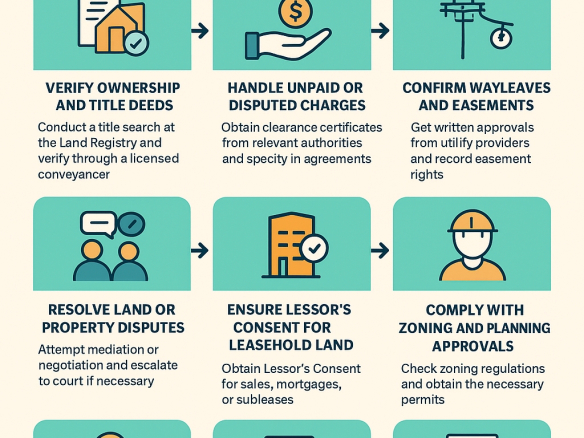

Navigating the intricate landscape of regulations is crucial for anyone looking to tap into Nairobi’s vibrant real estate market. The government has prioritized sustainable development, creating a landscape where investors and developers must align their initiatives with a variety of environmental, social, and governance criteria. Notably, stakeholders should focus on the following key aspects:

- Land Use Policies: Understanding zoning laws can help developers make informed decisions that adhere to sustainable practices.

- Environmental Regulations: Compliance with local environmental laws ensures that developments minimize ecological impact.

- Public Participation: Engaging with the community fosters transparency and encourages support for projects that consider local needs.

Adapting to these regulations can be facilitated by establishing strategic partnerships with local authorities and environmental organizations. By embracing a collaborative approach, developers can gain insights into regulatory expectations and streamline their projects. A glimpse at the current incentives illustrates the benefits that can be reaped:

| Incentive | Description |

|---|---|

| Tax Breaks | Financial incentives for projects that prioritize sustainable building practices. |

| Fast-Track Permitting | Streamlined processes for developments that demonstrate environmental responsibility. |

| Green Building Certifications | Recognition for developments that meet specific eco-friendly standards. |

Harnessing Technology and Innovation in Property Management

In the ever-evolving landscape of property management, the integration of technology is revolutionizing traditional practices. **Smart property management solutions** not only enhance operational efficiency but also improve tenant satisfaction. Properties equipped with **automated systems** such as IoT devices, smart locks, and energy management tools create an experience that is both user-friendly and secure. These technologies facilitate real-time monitoring and proactive maintenance, allowing property managers to address issues before they escalate, thereby saving time and resources.

Moreover, innovation in property management extends beyond physical assets; it incorporates digital platforms that streamline tenant communication and payment processes. Implementing **cloud-based property management software** ensures that all stakeholders—owners, tenants, and service providers—can access essential information from anywhere at any time. Consider the following benefits:

- Enhanced Collaboration: Real-time updates and cloud storage enable seamless interaction among all parties involved.

- Data Analytics: Advanced tools provide insights into market trends, aiding in informed decision-making.

- Cost Efficiency: Reducing paper usage and manual processes lowers overall operational expenses.

| Technology | Benefits |

|---|---|

| Smart Home Devices | Increases tenant comfort and security |

| Property Management Software | Simplifies administrative tasks and improves communication |

| Data Analytics Tools | Enables strategic planning and investment opportunities |

Anticipating Future Trends: What Investors Should Watch For

As Nairobi’s real estate landscape continues to evolve, several factors are likely to shape the market in the coming years. Investors should keep a close eye on the following drivers:

- Infrastructure Development: The expansion of transit systems, such as the Nairobi Expressway, is set to enhance connectivity and attract new businesses.

- Urbanization Trends: A growing population, particularly among the youth, is expected to increase demand for affordable housing.

- Technological Integration: The rise of smart buildings equipped with IoT technology could revolutionize the living experience and drive up property values.

- Sustainability Practices: The push for eco-friendly building materials and energy-efficient designs will likely attract investors focusing on sustainable growth.

To better capture the dynamics at play, it is essential to observe various market performance indicators. Understanding the rental yields and capital appreciation in specific neighborhoods can inform strategic investment decisions.

Monitoring these trends and metrics closely will help investors navigate the complexities of Nairobi’s real estate market and capitalize on opportunities as they arise.

Why Invest in Nairobi?

- Strategic Location

Nairobi serves as a regional business hub for East Africa, with a growing presence of multinational corporations, financial institutions, and tech companies. This makes it an attractive city for both residential and commercial property investment. - Growing Middle Class

The expanding middle class in Kenya continues to drive demand for both rental properties and homeownership, particularly in areas that offer a mix of convenience, affordability, and proximity to business hubs. - Infrastructure Projects

Ongoing and planned infrastructure developments, including new roads, railways, airports, and transport hubs, will continue to improve connectivity and raise property values, particularly in suburban areas and satellite towns. - High Rental Yields

Nairobi offers relatively high rental yields compared to other African cities, particularly in prime areas. Rental returns can be as high as 8-12% per year in some locations, especially for residential properties targeting expatriates, middle-class locals, or students. - Real Estate as a Safe Investment

Real estate in Nairobi has historically been seen as a relatively stable investment option. With a growing economy, a rising population, and increasing urbanization, property values are expected to continue appreciating over the long term. Additionally, land ownership in Kenya tends to be a reliable store of value, particularly in secure, well-established neighborhoods.

Top Areas for Real Estate Investment in Nairobi

- Westlands and Upper Hill

- Westlands is one of Nairobi’s most sought-after neighborhoods due to its proximity to the CBD, availability of modern amenities, and vibrant commercial scene. This area has attracted both residential developments and commercial offices. The ongoing construction of shopping malls and restaurants adds to its appeal.

- Upper Hill is the financial district of Nairobi, with many banks, insurance companies, and international organizations setting up their headquarters here. Commercial properties, particularly office spaces and mixed-use developments, are in demand.

- Kilimani, Lavington, and Kileleshwa

- These are desirable residential neighborhoods with a good balance of upscale living and accessibility to the CBD. The demand for both high-end apartments and affordable housing in these areas is expected to continue rising.

- Karen and Lang’ata

- These neighborhoods are favored by the affluent due to their spacious plots, leafy environments, and proximity to international schools and embassies. The development of new luxury homes and gated communities has seen property values increase over time.

- Ngong Road and Kiambu Road (Suburbs)

- Nairobi’s suburbs like Ngong Road and Juja Road are becoming increasingly popular for both residential and commercial development. Areas such as Kilimani and Kawangware along these roads have seen significant growth as they offer more affordable housing options for young professionals and families.

- Eastlands (e.g., Donholm, Umoja, and Bahati)

- Eastlands has long been an affordable and vibrant residential area for Nairobi’s working class. The area continues to see rapid urbanization, with developments targeting lower- to middle-income earners. Due to the ongoing infrastructural projects, property values are expected to increase in the coming years.

- Satellite Towns

- Nairobi’s satellite towns, such as Ruai, Limuru, Ruiru, Juja, Kikuyu, Kitengela, and Thika, offer more affordable housing options and present growth opportunities. These areas benefit from the growing demand for affordable housing, and their proximity to major highways and Nairobi’s expanding public transport system makes them attractive to both residential and commercial developers.

Future Property Value Outlook

- Growth in Suburban Areas

- As the city expands, we can expect continued growth in suburban areas such as Kiambu, Ruiru, and Kajiado. These areas are being increasingly linked to the city by improved transport networks, making them attractive to both residents and investors.

- Mixed-Use Developments

- Mixed-use developments combining residential, commercial, and leisure spaces will be a significant trend in Nairobi’s real estate market. These developments are expected to be in high demand, particularly in areas that offer both work and lifestyle amenities.

- Smart and Sustainable Buildings

- With global concerns about sustainability and climate change, there will be a growing demand for green, energy-efficient buildings in Nairobi. Developers are expected to adopt eco-friendly designs and technologies that cater to both local and international tenants looking for sustainable living spaces.

- Tech Hubs and Innovation Districts

- Nairobi’s emergence as a tech hub (Silicon Savannah) means that areas around technology parks and innovation districts are likely to see growth in demand for office spaces, rental housing, and commercial properties.

Conclusion

Nairobi remains an attractive and promising city for real estate investment due to its growing population, expanding economy, and ongoing infrastructural improvements. While key areas such as Westlands, Upper Hill, and Karen offer high-end investment opportunities, the burgeoning suburban and satellite towns present an excellent opportunity for more affordable investments. Monitoring factors such as economic growth, infrastructure projects, and shifts in the demand for residential and commercial spaces will help investors make informed decisions as they position themselves for future returns.

Join The Discussion